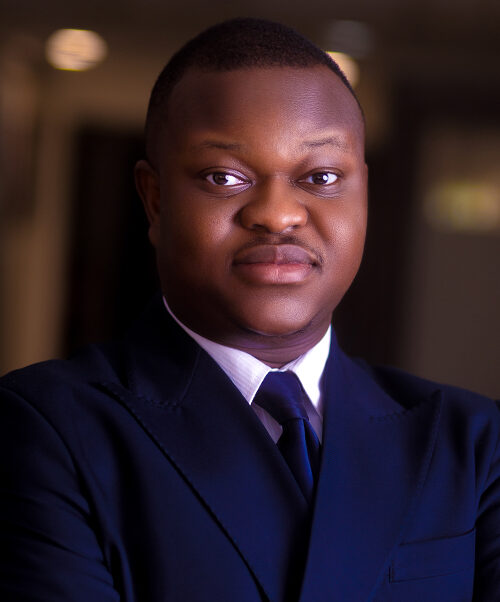

Desmond is a Partner in our Finance & Projects practice Groups.

He holds a Master of Laws degree from Harvard University, graduated with First Class Honours from the Nigerian Law School, and has a Bachelor of Laws from Ebonyi State University.

Desmond has extensive experience advising project companies, sponsors, borrowers, banks, funds, multilateral finance institutions, export credit agencies, other financial institutions and corporates on diverse transactions including project finance, acquisitions and divestments, power projects and other infrastructure development, strategic investments, international capital markets issuances, corporate finance and alternative funding structures.

Before joining Templars, he was a finance & projects associate at the Lagos-based firm of G. Elias & Co and a visiting associate at the London offices of Latham & Watkins, LLP under the International Lawyers for Africa secondment programme.

He is ranked in a number of international legal directories including IFLR 1000 Guide to the World’s Leading Financial Law Firms and Chambers Global Guide to the Legal Profession with clients and other independent sources describing him as “…a good problem solver and very client oriented”; “very effective… strong and bright”; ”one who delivers excellent work”; and “has a keen eye for the commercial objectives of a transaction”.

Desmond has served as a Senior Editor of the Harvard Business Law Review; as Vice-Chairman of the NBA Section on Business Law; and as a member of different technical committees of experts appointed by the Senate of the Federal Republic of Nigeria to advise its Banking, Finance, and Insurance Committee on much needed financial law reforms in Nigeria.

A Selection Of Relevant Expereience

- Azura Power West Africa Limited on its circa U$1billion financing for the development of a pioneering greenfield 459MW power generation plant in Edo State, Nigeria.

- Nigeria Sovereign Investment Authority (managers of the Nigerian Sovereign Wealth Fund) and Julius Berger International as project sponsors on the financing and development of the approximately US$1 billion Second Niger Toll Road and Bridge project in Southern Nigeria.

- Seven Energy International on the negotiation of a World Bank Partial Risk Guarantee in support of a Gas Supply Agreement for the Calabar Power Plant developed under the National Integrated Power Project initiative.

- Nigerian National Petroleum Corporation and some of their joint venture partners on their US$1 billion alternative funding arrangements structured as a forward sale of dedicated number of barrels of crude oil to be produced from designated fields.

- ExxonMobil on the acquisition by Black Rhino (a wholly owned subsidiary of Blackstone Group) of all the interests of ExxonMobil’s in Qua Iboe 540 MW gas fired power station in Akwa Ibom State.

- Engie Group (the world’s largest independent power producer) on its investment in a number of on-grid and off-grid power projects in Nigeria.

- Overseas Private Investment Corporation, Islamic Development Bank and African Development Bank on the financing for the development of a 75MW on-grid solar power project in Northern Nigeria.

- The lenders/arrangers on a US$325 million structured financing to the New Age Group for development of upstream assets in Nigeria including the Aje field located in OML 113 offshore Lagos.

- Globeleq, an Africa-focused energy sector investor on its acquisition of a 74% equity stake in Cummins, a leading C&I focused power company that provides distributed energy solutions to some of Nigeria’s largest companies.

- A syndicate of international and Nigerian banks on the financing for the construction of an entirely new city (Eko Atlantic City) off the coast of Lagos Nigeria.

- IHS Towers Nigeria and other members of the IHS Group on their US$950 million Eurobond offering including a separate US$150 million commercial bank tranche.

- The Federal Government of Nigeria on the grant of a concession for four of Nigeria’s busiest international airports.