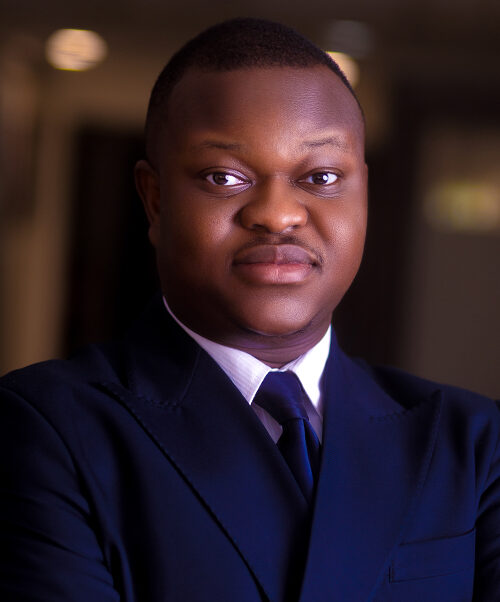

Sesan Sulaiman is a Partner in the Dispute Resolution & Tax Practice Groups.

She graduated with a second class upper division from the Igbinedion University, Okada and the Nigerian Law School, Abuja. She also has an M.Sc in International Business Management from the University of Sheffield, UK. Prior to joining Templars she was a policy analyst at the Tony Elumelu Foundation in Lagos.

A Selection Of Relevant Experience

- Advised a confidential client on the domestic application of international tax concepts such as Transfer Pricing, Base Erosion and Profit Shifting, as well as the application of bilateral trade agreements, limitation of benefits rules, level of substance rules, double taxation arrangements and general anti-avoidance provisions.

- Advised several multinational giants in the digital economy space in the wake of the Nigerian digital service taxation laws including Google, Visa, Spotify, Apple and Facebook.

- Advised a confidential client on the applicability of legislative amendments as well as extant Double Tax Treaty provisions on its proposed provision of c. $300 million cloud hosting services in Nigeria.

- Successfully represented an International Oil Company in a circa N6billion PAYE tax dispute with two state revenue authorities concerning the IOC’s alleged non-remittance of Personal Income Tax on behalf of its employees to the appropriate tax authority.

- Core member of the team that represented the USAN PSC Contractor Group in a PSC cost recovery arbitration of over US$1.5 billion against the NNPC. Successfully assisted the Contractor in negotiating a favourable settlement of the dispute and obtaining a consent award.

- Core member of the team that successfully represented an Emerald Energy Resources in an LCIA arbitration instituted by an international financial advisor over the payment of fees allegedly earned in procuring investors and debt financing for the development of its Oil Block.

- Advised an indigenous natural gas supplier in relation to claims made in arbitration (commenced under the American Arbitration Association) which arose out of the US$500million contract to acquire two liquefied natural gas plants from a leading technology giant.

- Advised a multinational entity on the tax planning and structuring of a loan cash pooling scheme between the multinational entity and its affiliates, including Nigerian subsidiaries.

- Advised on the validity of a US$79 million tax assessments on Phillips Oil, a ConocoPhillips subsidiary in Nigeria; successfully negotiated a 60% reduction on the tax liability.

- Represented and secured a landmark judgment in favour of TotalEnergies in a dispute concerning the application of NNPC’s Official Selling Price in the calculation of Total’s liabilities. Judgment was upheld on appeal.