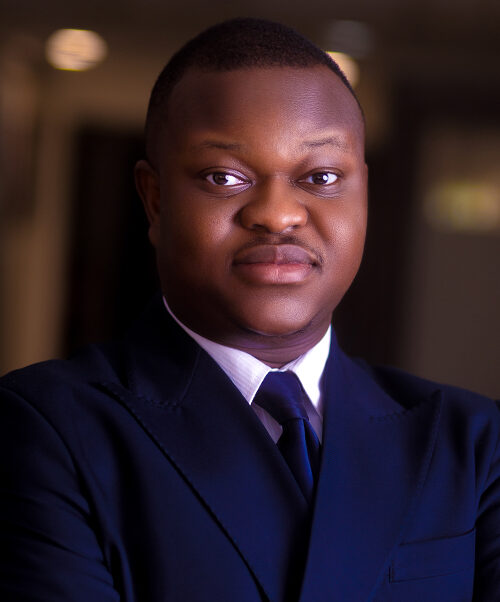

Dupe is a Partner in the Finance and Energy & Projects practice groups.

She has extensive experience advising a broad range of clients including project sponsors, corporates, banks, funds and other financial institutions on diverse transactions including project and structured finance, energy and other infrastructure projects, corporate restructuring and insolvency, mergers & acquisitions, PPPs and Islamic finance.

While at Templars, she had a short stint as a Visiting Associate in the Projects and Corporate teams in the London offices of Latham & Watkins LLP, in line with Templars’ philosophy of supporting secondments for its lawyers.

On account of her work on various path-breaking transactions, she is recognised by international legal directories, IFLR 1000 Guide to the World’s Leading Financial Law Firms and the Legal 500.

A Selection Of Relevant Highlights

- Oil Mining Lease (OML) 17 Acquisition Financing:

Dupe led the team that advised Heirsholdings Oil & Gas Limited (formerly TNOG Oil & Gas Limited) on the US$1.1 billion debt financing for its US$800 million acquisition of the 45% participating interest in OML 17 from Shell, Total and Agip and led the negotiations of the deferred acquisition purchase price component with the sellers.

- Sinopec & Addax Transfer, Settlement and Exit Deal:

Advised Sinopec and its Addax subsidiaries on their transfer, settlement and exit arrangements with Nigerian National Petroleum Company Limited (NNPCL) in relation to four oil mining leases (OMLs) operated by Addax Petroleum under production sharing contracts with NNPCL, the first major transaction to be undertaken by NNPC Limited following the passage of the Petroleum Industry Act 2021

- Lekki Deep Sea Port Project Development and Financing:

Advised the project company, Lekki Port LFTZ Enterprise Limited and the initial sponsors, Tolaram Group on the development of the Lekki deep sea port project granted on a 45-year build-operate-transfer concession from the Nigerian Ports Authority and guaranteed by the Federal Government of Nigeria, as well as the financing of the project comprising Sinosure-backed debt financing from China Development Bank and the equity financing obtained from China Harbour Engineering Company.

- NNPC JV Forward Sale Financings:

Advised Nigerian National Petroleum Corporation, The Shell Petroleum Development Company of Nigeria, Total E&P Nigeria Limited (as Sponsors) on the US$1 billion and subsequent US$500 million alternative funding structured as a pre-export financing provided by a consortium of international and local banks for the purposes of funding drilling and non-drilling activities.

- LNG Expansion Financing:

Advised the syndicate of lenders, including export credit agencies (K-sure, K-EXIM and SACE), DFIs (Africa Finance Corporation, Afrexim Bank), Nigerian and international banks on the US$3 billion multi-tranche corporate financing provided to Nigeria LNG Limited for the development of its Train 7 Expansion Project.

- Debt Financing of the NGC and Seplat Sponsored Assa North Ohaji South Gas Project:

The lenders on a US$260 million dual currency senior secured project financing to ANOH Gas Processing Company Limited for the development of the 300 million scf/d Assa North Ohaji South gas processing plant, one of seven critical gas development projects (7CGDPs) earmarked by the NNPC and the Ministry of Petroleum to bridge the demand-supply gap in the Nigerian domestic gas market.

- U.S. DFI Nigerian Bank On-lending Transaction:

United States International Development Finance Corporation (formerly Overseas Private Investment Corporation) on the US$200 million financing to Union Bank of Nigeria plc for on-lending to small and medium scale businesses in Nigeria, particularly women-led, women-supported and women-owned businesses, and investment in the bank’s digital banking projects.

- ICD Islamic Finance Transactions:

Led the team that advised Islamic Corporation for Development of the Private Sector (ICD) (the private sector arm of the Islamic Development Bank Group) on its Global Line of Finance to Jaiz Bank plc, Fidelity Bank, Union Bank of Nigeria plc and Suntrust Bank Nigeria Limited, and separate lines of finance facilities to Sterling Bank plc and Wema Bank plc for the purposes of financing small and medium scale businesses in Nigeria on a murabaha basis.

Expertise

Banking & Finance, Energy & Natural Resources, Mergers & Acquisitions.